Learning leaders increasingly use vendors to ease pressures brought on by budget and resource constraints. But are they selecting the right ones to meet their organizational and user needs?

by Cushing Anderson

February 28, 2014

Learning and development organizations are increasingly complicated, multifaceted entities spanning learning technology, content development and delivery, and measurement. With expanding responsibilities often constrained by budget and a lack of internal expertise, many organizations use external partners to assist them with important activities.

How CLOs leverage partners is almost as complex as learning and development itself. But cultivating a deeper understanding of the priorities and pitfalls of learning business partner dynamics can help CLOs build more effective relationships.

Every other month, market intelligence firm IDC surveys Chief Learning Officer magazine’s Business Intelligence Board on a variety of topics to gauge the issues, opportunities and attitudes that are important to senior learning executives. This month, for the first time, 280 BIB members provide their perceptions on business partnerships, how they choose vendors and where they are satisfied and dissatisfied with training vendor partners.

Choosing the Right Vendor

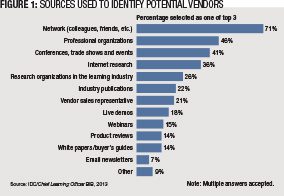

When CLOs are looking for a new learning vendor partner, they leverage a wide range of sources, but personal networks, professional associations and conferences, trade shows and events are among the most important (Figure 1).

When CLOs are looking for a new learning vendor partner, they leverage a wide range of sources, but personal networks, professional associations and conferences, trade shows and events are among the most important (Figure 1).

There are also many secondary sources, including buyer’s guides, industry publications and market research, available to identify appropriate training partners. After narrowing down prospects from a wide net, CLOs leverage a range of criteria to assess vendor or product suitability.

One of the most important factors in selecting a vendor is product or service quality, followed closely by results produced, value and the ease of working with the vendor (Figure 2). Second-tier characteristics that lead to benefit for CLOs include innovation, customization and problem solving.

Essentially, what matters most is getting the job done, and what matters somewhat less is the method or approach to achieve results. Third-tier characteristics support capabilities that lend credibility to products or services, but are tangential to the primary objective: recommendations, related services or support and a partner’s brand reputation.

While it might be easy to recommend focusing solely on quality or results when selecting a learning partner, second- and third-tier characteristics are also important. The presence of second-tier criteria suggests a vendor is stretching the bounds of known solutions. While that might not be essential for current issues, it might be the beginning of a solution to a bigger problem in the future.

Third-tier characteristics can help sell internal stakeholders on a selection. Recommendations go a long way to support a vendor’s credibility, and support services, or process or outsourcing support, demonstrate a vendor’s confidence in making the product work in the real world.

When evaluating a partner, it’s also important to determine whether products or services can be customized. A partner and its product’s ability to stretch beyond current or standard offerings is essential to a CLO’s long-term satisfaction.

Evaluating Products

Evaluating a product is related to evaluating the vendor partner, but with different criteria and slightly different priorities.

When attempting to define high quality for products, the characteristics are fairly straightforward (Figure 3). The top four criteria are intertwined. The best products meet user expectations, are appropriate for the target employees and fit into the organizational context, often through customization. This makes sense. Product quality, or fit for purpose, is measured by meeting expectations in context and achieving those expectations through customization.

When attempting to define high quality for products, the characteristics are fairly straightforward (Figure 3). The top four criteria are intertwined. The best products meet user expectations, are appropriate for the target employees and fit into the organizational context, often through customization. This makes sense. Product quality, or fit for purpose, is measured by meeting expectations in context and achieving those expectations through customization.

The next tier of characteristics may support that fitness, but are less significant: Scalability, cost, availability and ease of use. These characteristics are reasonable subordinate expectations to user expectations, such as meeting cost constraints, and fitting into the organizational context, such as a large, dispersed employee base. But they are less important than first-tier product evaluation criteria.

Essentially, while it is easy to find a product and search for the right circumstance in which to deploy it, that approach is backward. The first step in identifying a high-quality product is understanding the problem to be solved and users’ expectations.

CLO comments about what makes a great business partner reflect this need for alignment between vendor and problem. One CLO described the characteristic that makes a great partner as “flexibility and a willingness to understand our core business, not just the learning business.” Or, as another CLO described it, “They try to understand my business issues and deliver quality products and services to resolve those issues.” Most CLOs agreed success occurs when the vendor’s “values are aligned with what the organization wishes to accomplish.”

Vendors have to be willing to ask the right questions, listen to the answers, customize packages and deliver as expected. They also need to understand potential opportunities and pitfalls; “they help you think of the questions you have forgotten to ask.” Essentially, “Our favorite vendors treat us as if we’re their only clients and that our problems keep them up at night. They’re responsive, flexible, and bring to us the latest trends and innovations within the industry.”

Vendor Partnerships Are Usually Successful

CLOs are quite satisfied with learning and development business partners. Four out of 5 enterprises use external partners and providers for some aspect of their learning function, and more than 85 percent report they are satisfied with providers.

CLOs report greatest satisfaction with partners in executive education and coaching — 90 percent; learning delivery — 88 percent; and learning strategy and organization consulting — 88 percent (Figure 4).

Despite general satisfaction with partner performance, there is room for improvement. While 75 percent of CLOs are either satisfied or very satisfied with their learning technology provider, only 28 percent are very satisfied. Worse, only 22 percent of CLOs are very satisfied and another 40 percent are satisfied with learning analytics.

The areas of improvement relate to the partner’s ability to work with the enterprise to develop appropriate products. One CLO said partners “too often try to impose an existing solution rather than customizing to fit the organization.” Another criticized “vendors who continue to try to sell more products or services in lieu of really understanding our business.” This equates to vendors “trying to meet their own business plan and revenue goals rather than trying to meet our needs.”

Another CLO sees vendors chasing white rabbits. “Sometimes their solutions feel trendy and I’m not sure they will result in people and organizational capability that will be impactful or sustainable over time and as the business changes.”

In some cases, technology vendors get the worst knock. The dysfunction begins with the product, and carries through to the consultants and support organization. “We continue to have challenges with learning management vendors and learning technology vendors (virtual classrooms) charging for mandatory upgrades, [and offering] excuses when technology isn’t working” as opposed to providing solutions. Some partners “carry a bag of solutions that they try to shoehorn you into.”

CLOs said even if vendors leverage research to guide development or deploy solutions, they often “lack insight to understand strategic needs of our business and how solutions can be tailored to meet these needs.” This may be systemic, or it may be the “quality of consultants who lack the ability to think end-to-end solution.”

But CLOs are optimistic there is meat behind existing solutions, and they’re hopeful they can take advantage of that knowledge and capability if they can access it. “I would like for them to bring more ideas to the table without us having to knock down doors for it.” However, to be really satisfied, CLOs may need to be more proactive. “Our vendors are thoroughly screened; there are none that have not met our needs.”

For most CLOs, working with learning partners — either for content, technology or services — is necessary. Maximizing the potential and ultimately realizing value from those relationships is essential to success. The BIB research suggests several strategies for CLOs:

- Before product or service provider selection, ensure all stakeholders are clear on organizational requirements.

- Cultivate a range of sources to ensure the widest breadth of possible solutions and partners. Maintain a smaller set of connections to help vet new learning partners. Formally and thoroughly vet these partners before signing a contract.

- Even when satisfied with a current team of providers, expect more. There is often more insight, innovation and opportunity for value than is obvious in the first, or tenth, solution draft.